To extend its market leadership in Central Europe for (wood and glass) doors to other European markets with integrated, sustainable solutions. This is the goal of Arbonia AG, having achieved a market-leading position in its core markets in Central Europe.

Future-oriented product portfolio with growth products

Arbonia's product portfolio comprises established or traditional products that generate significant cash flow on the one hand and growth products that are growing strongly and therefore still require investment on the other. The Doors Division and its doors and casings generate an attractive cash flow. However, this is significantly steamed by the ongoing investment program to increase production capacity, which will be completed in 2023, so that cash flow will increase significantly in connection with this.

Arbonia is addressing the ongoing megatrends of urbanization, energy efficiency andCO2 neutrality, and digitalization & automation with both its traditional and, above all, its growth products.

Cost leadership

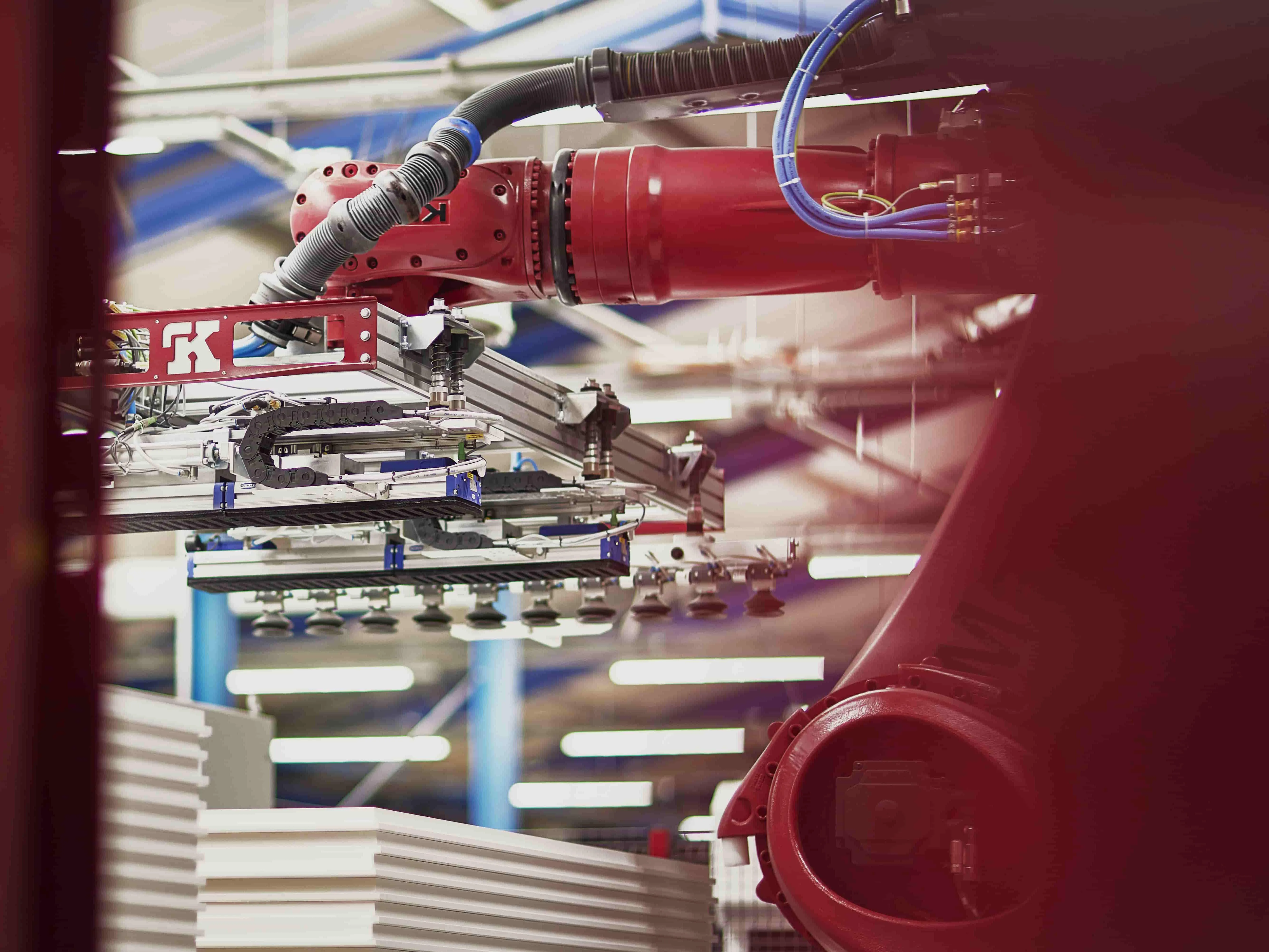

In recent years, Arbonia has invested significantly in the automation of its door production, thus laying the base for its cost leadership. The locations in Central and Eastern Europe allocate short distances and attractive cost structures and are therefore also optimally located geographically.

In addition, Arbonia has always invested in vertical integration, integrating individual processes from the value chain, which has had a positive impact on margins on the one hand and simplified processes on the other. Examples of this include the construction of an in-house painting line at RWD Schlatter in Roggwil (CH) and, most recently, the acquisition of GVG in Deggendorf (D), which supplies toughened safety glass for the Glass Solutions business unit.

Positive market outlook for residential construction

There is a very positive outlook for residential construction by virtue of urbanization and the age of the building stock, as well as the additional support provided by the European Green Deal.

Both residential construction and renovation have been able to catch up on a large part of their construction activity following the restrictive protective measures during the pandemic. However, the (Central) European markets also offer excellent perspective views in the medium to long term. On the one hand, there is the strong trend towards urbanization, which applies to almost all countries and results in such a high demand for living space that new building cannot keep up with it. Due to the high demand, tradesmen's capacities are so heavily utilized that renovation activity can hardly be increased. As a result, the building stock in Europe continues to get older and renovations have to be carried out as soon as the new demand is more or less satisfied. A large proportion of the building stock must at least be renovated to make it more energy efficient if the climate targets of European countries are to be achieved. In Germany, for example, such a development is not foreseeable, even in the medium term, because around 3 annual completions of apartments (~ 750,000) are waiting for construction to start.

Proven track record

Thanks to the proven track record of our management with a high proportion of shares in their remuneration, we are making the right investments to increase productivity and profitability, thus creating value for shareholders.

Following the sale of the Windows Division, the management of Arbonia has successfully completed a transformation process lasting many years from a holding company with several divisions to the European market leader for interior doors and access solutions with the sale of the Climate Division. Through investments, acquisitions, production consolidations and relocations, considerable added value was created and distributed to shareholders. These include the Board of Directors and Group Management of Arbonia AG, who receive part of their remuneration in shares. In the case of the Board of Directors, 50% of its remuneration is paid in shares and the Group Executive Management in turn receives 50% of its variable remuneration in shares. In both cases, a vesting period of 4 years applies.

The current (as at 31.07.2024) shareholdings of the Board of Directors, Group Management and senior management (also with a share component in the variable remuneration) amount to round 3.9% of the share capital. With this line out, Arbonia ensures that the management creates value in the long-term interests of the shareholders.